Free Cookie w/ Snack Trade-in at Insomnia Cookies

ANNNWZZD 3 in 1 Wireless Charging Station for Apple Just $10.79 (Reg. $35.99)

Coach Wristlets from $28 Shipped!

Free Pickleball Set OR Trunk Organizer + AARP for 1 Year Only $12

Chigant Woman Boho Beach Loose Casual Dress Tunic Dress Now $11.99 (Was $29.99)

ACEMAGIC Laptop Computer, 16GB DDR4 512GB SSD, Quad-Core Intel N95 Processor $308 (Reg. $1,299)

Dove Beauty More Moisturizing Bars Only $0.64 Per Bar Shipped

Cute Womens Cotton Sleeveless Sleepwear Set Only $11.99 Each!

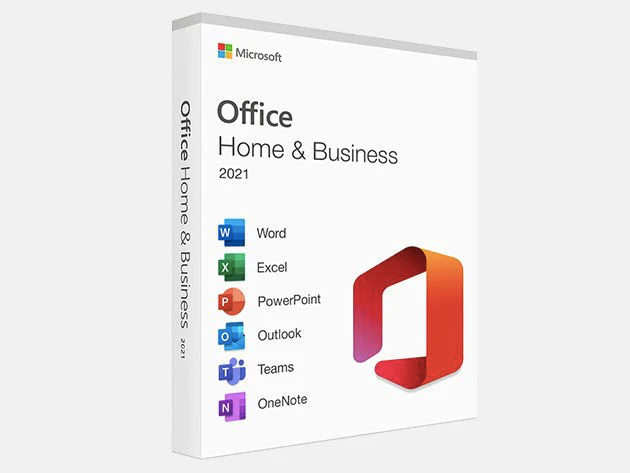

Get Microsoft Office for LIFE for ONLY $19.88 **Available Again**

Free Sam’s Club Celebration Expo Event on April 20 from 11am-4pm

Hiware 4 Piece Drill Power Scrubber Brush Cleaning Kit Now $6.99 (Was $16.00)

2 Pack of Womens Ribbed Basic Top Knit Tank Tops Now $11.49

Free Air Wick Advanced Warmer at Walmart – $4 Value!

HURRY!!! Folgers Black Silk Dark Roast Coffee Only $6.33 Shipped **$10 at Walmart

Women’s Summer Swimsuit Beach Dress Only $13.99 Each!

Free Playful Garden Cart Planter Workshop for kids at Lowes on April 20