24 Pack of Dole 100% Pineapple Juice Only $10 Shipped

LOVE THESE!!! Ginkgo Colorful Set of 6 Large Taco Stands Only $6.50

Mueller Retro Toaster 2 Slice with 7 Browning Levels Now $24.98 (Was $49.99)

FloTool Spill Saver Multi-Purpose Funnel Only $0.98 (Was $2.69) **64% Off**

VTech Turn and Learn Driver, Yellow Now $10.99 (Was $19.99)

Illuminate Your Home for Less: eufy Floodlight on Sale for $89.99 (Reg. $219.99)!

Up to 60% off Costa House Plants at Lowe’s TODAY ONLY!

JOYSTAR Vintage 12 & 14 & 16 Inch Kids Bike with Basket $85 Shipped (Reg. $180)

OAKRED 6ft Thick Faux Olive Tree for Indoor with Natural Wood Trunk $35.99 Shipped

Play-Doh Slime and Foam Metallic Mix-In Mania Set $5.99 **80% Off**

Sainlogic Wireless Indoor Outdoor Weather Station with Rain Gauge $89.99 (Reg. $160)

Gain Laundry Detergent Plus Aroma Boost 2-Pack Now $9.48 Shipped – $4.74 Each!

Free Gift Box for Teachers at Staples!

10 Pack of Sterilite 6 Qt. Clear Plastic Storage Boxes with Lids Only $10.98

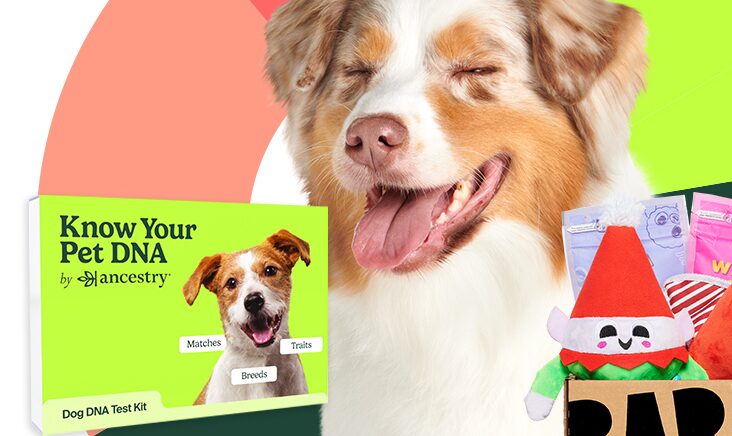

Possible Free Hartz Oinkies Chickentastic Tender Twirls + Collagen Dog Chews

Free SeaWorld, Busch Gardens, Sesame Street Tickets for Military and Family